An analyst who nailed the pre-halving Bitcoin correction this year believes BTC is gearing up for a massive breakout.

Pseudonymous analyst Rekt Capital tells his 507,400 followers on the social media platform X that Bitcoin may soon surge out of the current consolidation range based on historical precedence.

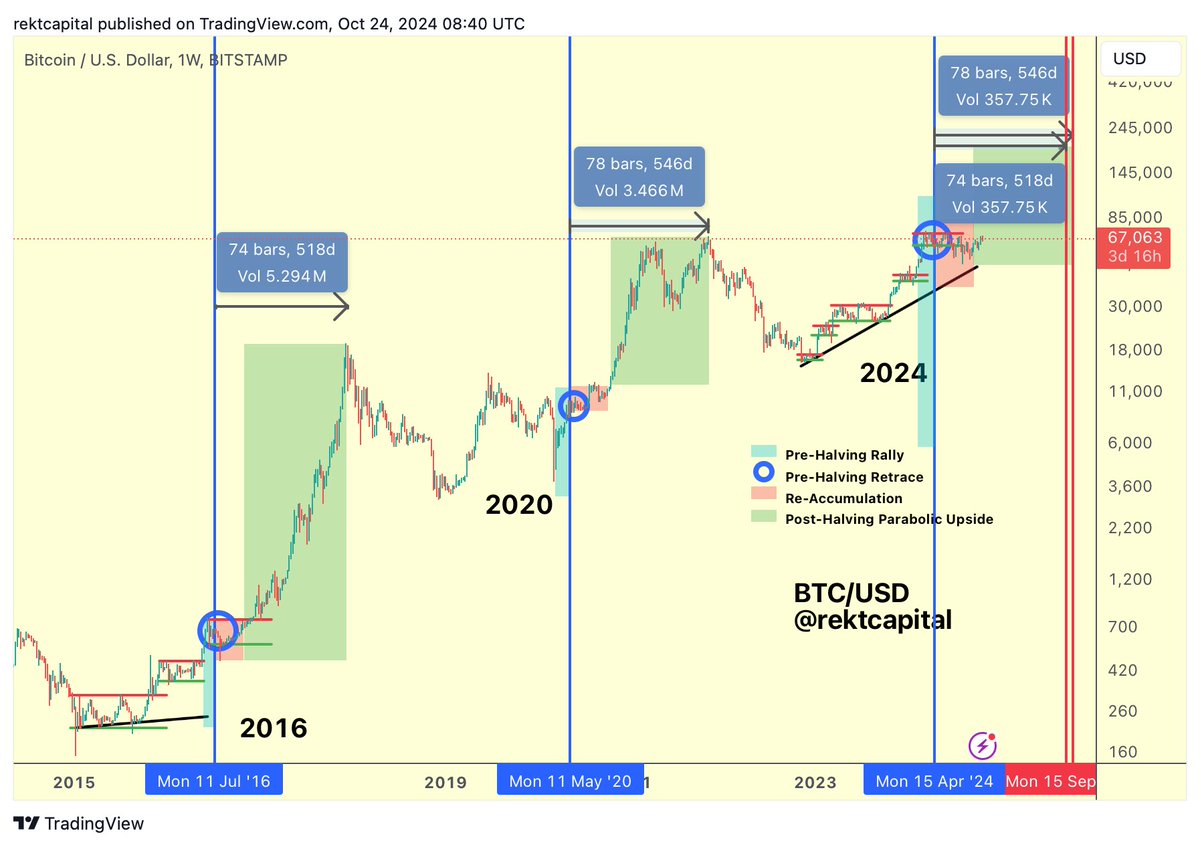

“Bitcoin is still in the ‘re-accumulation around old all-time highs’ phase (green circle). But not for too much longer.”

Next up, the analyst suggests that Bitcoin may reach its cycle peak in about a year based on how long it previously took BTC to hit cycle peaks after the halving events when miners’ rewards are cut in half. Bitcoin’s most recent halving event was in mid-April.

“In the 2015-2017 cycle, Bitcoin peaked 518 days after the halving. In the 2019-2021 cycle, Bitcoin peaked 546 days after the halving. If history repeats and the next bull market peak occurs 518-546 days after the halving that would mean Bitcoin could peak in this cycle in mid-September or mid-October 2025.

Currently, Bitcoin is still accelerating in this cycle by approximately 35 days or so. So the longer Bitcoin consolidates after the halving, the better it will be for re-synchronizing this current cycle with the traditional halving cycle.”

Bitcoin is trading for $67,666 at time of writing.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3