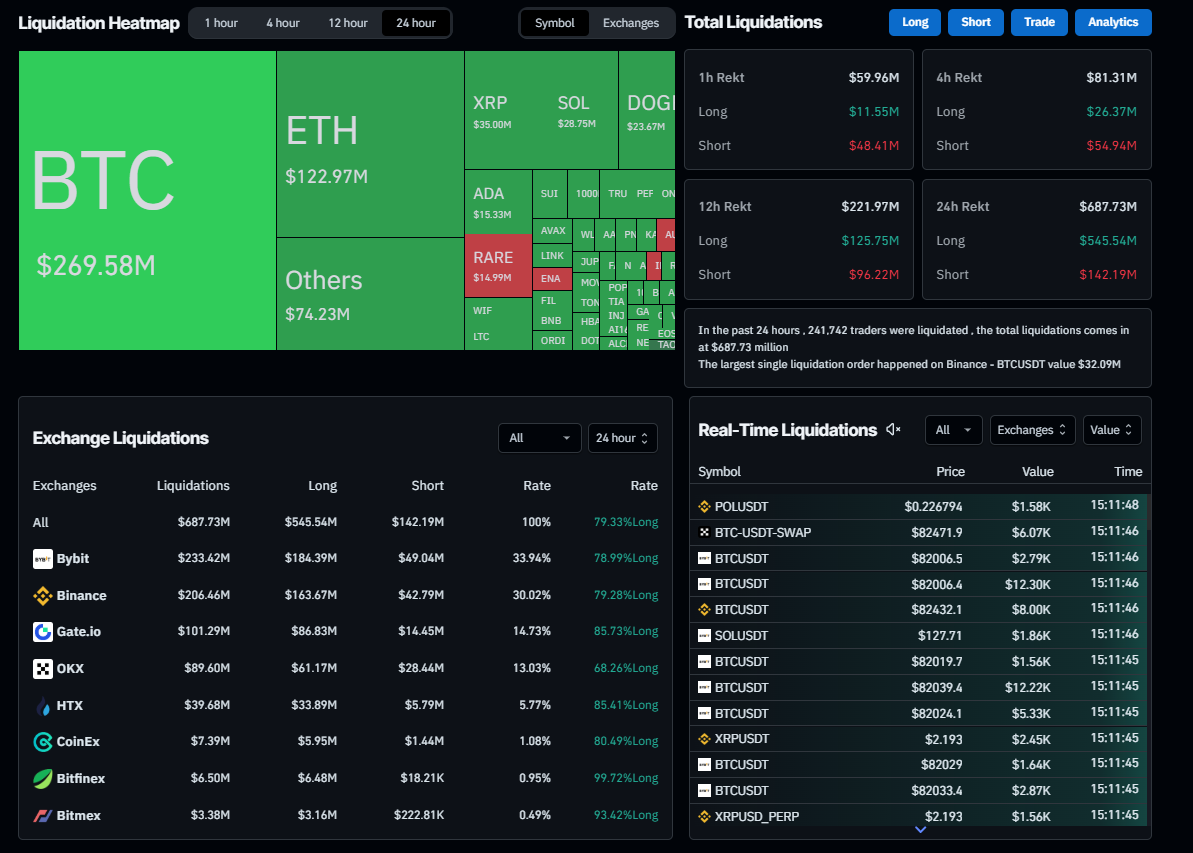

Bitcoin (BTC) hovers around $82,000 on Monday after falling nearly 15% last week. This price correction triggered a series of liquidations across the crypto market, totaling $687.73 million in the past 24 hours. A QCP Capital report highlights that momentum was derailed by the Bybit hackers cashing out at least $300 million of their record-breaking $1.5 billion crypto heist on Sunday, causing BTC to decline again.

MicroStrategy’s stock has lost 47% since November 2024, falling from $543 to $287.18 as of March 9, 2025. Given MicroStrategy’s deep financial and strategic ties to the digital asset, this sharp decline raises serious concerns for Bitcoin (BTC) and the broader crypto market.

With MSTR now at a three-month support level of $288.00, failure to hold this key level could lead to a breakdown toward $248, $208, and even $135.26—a scenario that would likely put significant downward pressure on Bitcoin.

The crypto market is down 4% in the last 24 hours to $2.7 trillion and has been under selling pressure since Sunday afternoon. This can be attributed to a desire to convince the community of the Crypto Summit’s weak results, even though the outcome was quite predictable and not that bad. Trading volumes over the weekend were extremely low, reducing the value of the bearish signal.