Real Vision’s chief crypto analyst says that it’s hard to be anything but bullish toward Bitcoin (BTC), identifying one catalyst that could send the crypto king flying later this year.

In a new thread, crypto strategist Jamie Coutts tells his 36,000 followers on the social media platform X that a recent move in the US Dollar Index (DXY) has historically predated a rally for the flagship digital asset.

“When looking at this recent move in the DXY through a historical lens, it’s challenging to be anything but bullish. I ran a signal screen for three-day negative moves of more than -2% and -2.5% and found they have all occurred at Bitcoin bear market troughs (inflection points) or mid-cycle bull markets (trend continuations).

As always with Bitcoin, the statistical significance of medium-term signals is severely constrained by dataset history (not enough), but this is an objective data point to keep in mind.”

According to Coutts, in 2013, there were eight occasions when the DXY declined by at least 2.5%. BTC went up each time afterward with an average return of 37% in 90 days.

When looking at when the DXY declined less than 2% during the same time frame, the data shows 18 instances, 17 of which saw BTC climbing afterward with an average return of 31.6% in 90 days.

Coutts goes on to say that the stage is set for BTC to skyrocket in a couple of months.

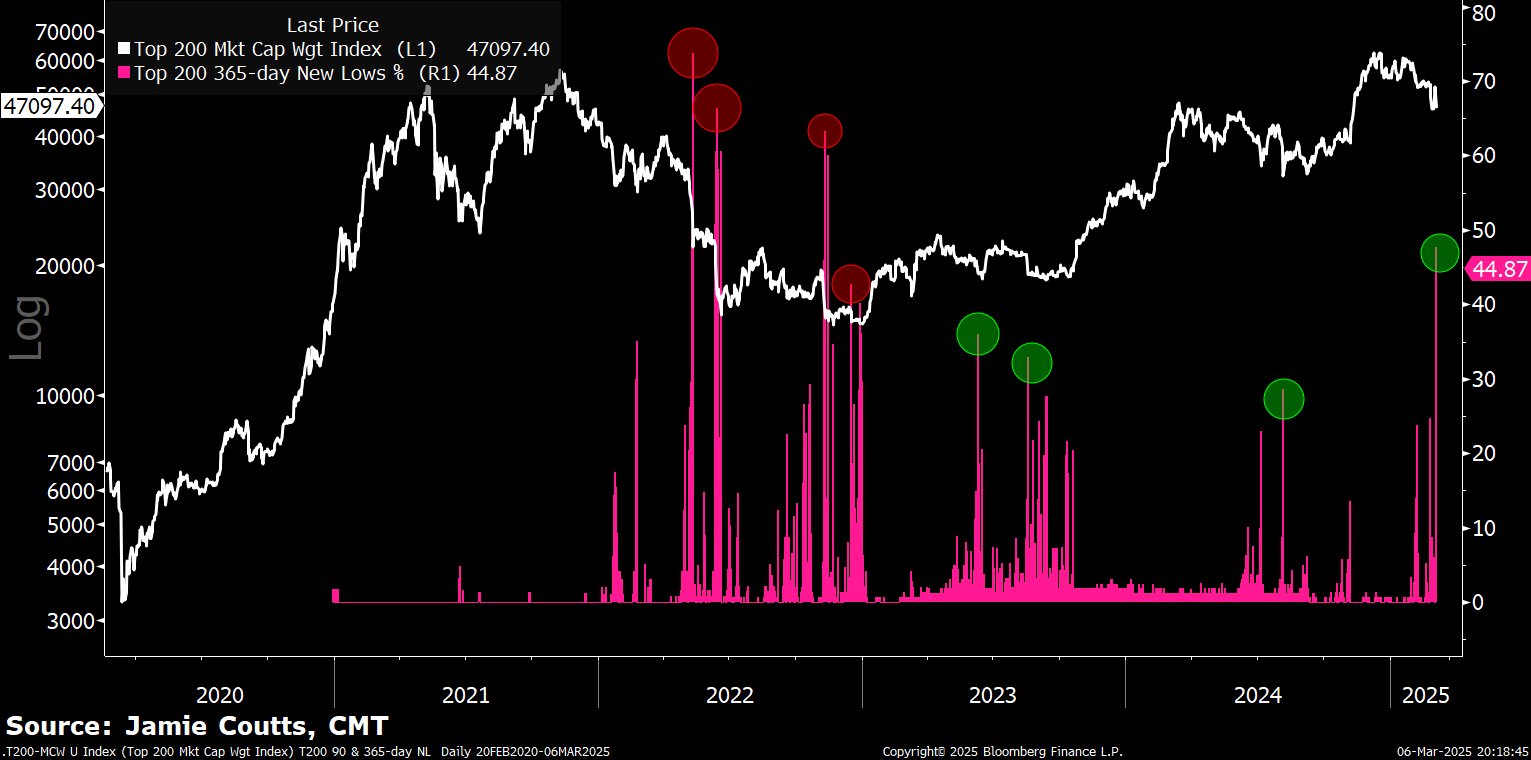

“This week had it all. The DXY saw its 4th largest negative three-day move – massively liquidity-positive. Just as Bitcoin nuked and had its worst Feb in a decade. Meanwhile, in altcoin land, the Top 200 crypto index puked one more time. The chart shows that 365 days of New Lows hit 47%, a hallmark of capitulation in a bull cycle. The stage is set for a new all-time high in Bitcoin and Top 200 aggregate market cap by May.”

Bitcoin is trading for $87,881 at time of writing, a fractional increase on the day.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney